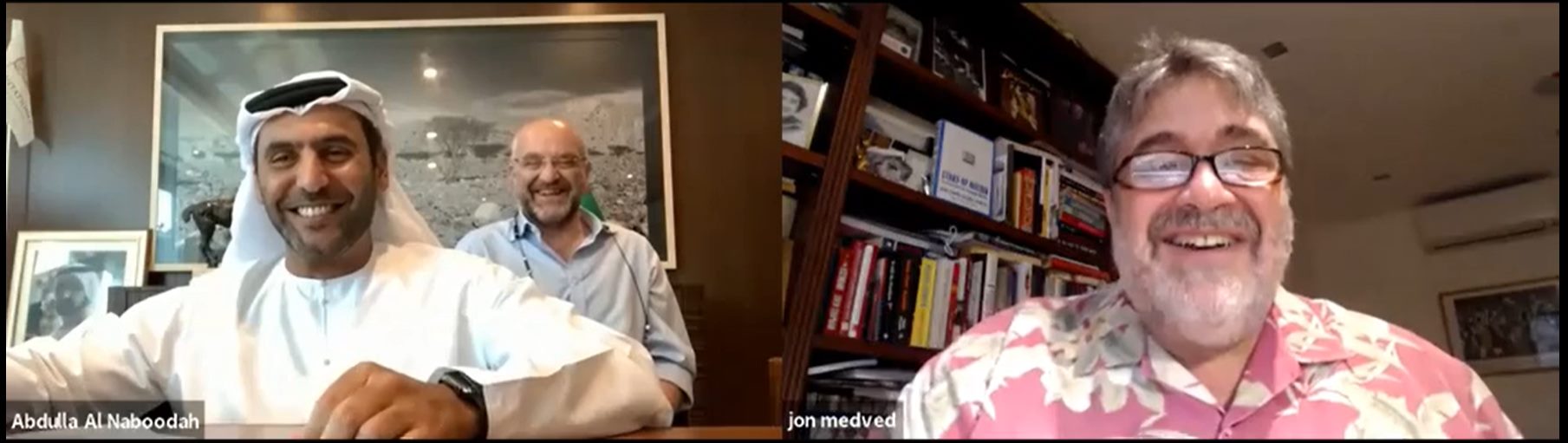

Investors Abdullah Saeed Al Naboodah from the UAE and Jon Medved from Israel are the first to start sharing tech and investment deals between Israel and the United Arab Emirates

Israel’s most active investor along with his counterpart in the United Arab Emirates are banding together to create a new tech investment partnership. The announcement has come hot on the heels of a peace deal between Israel and the United Arab Emirates last month. If you read some of the commentary between the two men you’d imagine it’s the biggest new love story on the planet: but I see it as a chance for individual investors to help grease the wheels of peace and an “in” for cleantech companies from Israel eyeing the Gulf region to explore new business opportunities.

OurCrowd, the world’s largest global venture investing platform, signed a memorandum of understanding this week with UAE businessman Abdullah S Al Naboodah to create Phoenix as part of a 100m investment fund. Veteran investor Sabah Al-Binali will head OurCrowd’s Gulf operations.

This is the first announced partnership between an established UAE corporation and a major Israeli venture investment firm at this level of commitment. Until now bilateral trade and investments have been rare and almost always under the radar with Luxembourg somewhere in the story as a middle man.

Investing for peace

Times have changed for good, I hope: founded by Jonathan Medved, OurCrowd is a global leader in equity crowdfunding and is Israel’s most active venture investor with $1.5B of committed funding.

OurCrowd plans on identifying and supporting UAE-based startups seeking growth and development in Israel, as well as leveraging its diverse portfolio of 220 companies in the UAE.

The model of crowdfunding for equity means that individuals can invest in “peace” with real money, with as little as $50,000 USD. Regular venture firms won’t accept less than $1 million USD to enter a deal.

While individual investors may not have a lot to say about how the investments are used, they can voice their interest in a portfolio that is well balanced and suggest businesses meet sustainability goals, which are mostly absent in Israeli companies.

Phoenix in Dubai, led by Al Naboodah, will serve as an investment platform for individuals and family offices located in the Gulf seeking opportunities to invest in Israeli tech. Phoenix will enable investors to access OurCrowd’s tech investment opportunities in Agriculture, Medtech, AI and robotics.

Abdullah Saeed Al Naboodah

Al Naboodah told the Financial Times: “The commodity-fuelled excess financial capital of the UAE fits well with Israel’s surplus technology and innovation. This will accelerate investing in opportunities both in Israel and the UAE.”

Jon Medved, OurCrowd founder and CEO

Medved said: “The signing of OurCrowd’s first MOU in the UAE less than a month after formal normalization between the UAE and Israel shows our deep commitment to building relationships, and growing business in the UAE and beyond.”

The better known portfolio companies taken on by OurCrowd include the data-protection company BioCatch, the smart irrigation company CropX, and the cyber intelligence company Sixgill.

OurCrowd cleantech companies suited for business in Dubai?

We reached out to Medved and Leah Stern from his team and they suggested these OurCrowd portfolio companies as potential businesses suited for expansion in the UAE:

Enverid cleans a building’s indoor air at the molecular level, enabling the building to use far less outside air ventilation while improving indoor air quality.

Ripple: the reduction of greenhouse gases by replacement of dairy with plant based milk, made from peas. Israel is going wild with food startups right now. This vegan cheesemaker is eyeing an IPO.

Skytran: Urban mobility solution via green flying pods on elevated rails. A little too modern for Israel right now, but perhaps Dubai is a better fit?

Juganu installs proprietary street lights maximizing energy efficiency and lighting stability.

ClimaCell is a hyper-local weather intelligence platform, which uses the Weather-Of-Things to predict the weather. This is combined with air quality data that they collect as well in order to help companies decide if it is better to introduce outside air into the office at a certain time, or circulate the indoor air instead, on a hyper-local level.

What’s the big deal about crowd funding for angels?

A group of people investing increments in as little as $50 to $100K in a new company was always for the realm of angels, but risk-averse investors in the US wanted to get involved in Israeli startups. They didn’t want to buy Israeli bonds from the time of their grandparents.

I saw it starting in the mid-2000s when there was a frantic urge to invest in Israeli cleantech companies, solar and water specifically, with virtually no mechanism to help investors access deals without significant in pocket funds and savvy.

Investors were rushing into Israel coming to Tel Aviv looking for ways to get intel before the next exit. They knew something was brewing in Israel since M Systems and Mirabilis (ICQ) exited and made millionaires from engineering geeks, many with ties to the army.

The world sensed that Israel was brewing something big and they were right: since Israel has had exits in multiples of billions including Mobileye: $15.3 billion (2017), Frutarom (with a terrible environmental track record) $7 billion (2018), NDS $5 billion (2012) and Chromatis $4.7 billion (2000).

Back to the early 2010s and crowdfunding was just starting to make sense. People were sharing office spaces (though local hubs) and then living quarters (Couchsurfing) and the whole idea of social investments was starting to catch on.

We heard about bands turning to the crowd to produce a music video or Kickstarter for a product and not long after, along with passing regulatory hurdles, crowdfunding for investors became a thing. This was a desirable model for American Jews to be able to support Israel without just pouring philanthropic aid into the country carte blanche.

By 2013 the Israeli-American investor Jonathan Medved stepped up to the plate and started a fund called OurCrowd that would allow almost any sized investor to own a piece of the Israeli startup pie. This excited Jews in America and it it gave new wind of support for young entrepreneurs in Israel that they they could go beyond the expensive government-funded incubator model and get funding without giving away more than half of their business in equity.

Medved is a marketing genius who probably knew all this. He is also known as a business ambassador – one who has collected some of the best to join his tribe from the media, tech and investment world.

____

Have something to say? A cleantech company you want to pitch or an idea for improving sustainability goals in the Middle East? Email me: [email protected]