Cannabis is still illegal under federal law in the United States. But many states have already embraced its advantages. In recent years, cannabis-use legalization policies have sped up along with the uptrend in the number of users. Statistics show that about four million Americans use cannabis. And we can guess those numbers are probably a lot higher especially when it comes to recreational use. Indeed, it has overcome prejudices to become one of the most popular therapeutic options.

The global cannabis market is growing and sprawling like a weed (no pun intended). It may expand by a compound annual growth rate (CAGR) of 24.3 percent, reaching $82.3 billion by 2027. With its growth prospects, investors and businesses are optimistic about its future trends. It’s no wonder they’re geared toward cannabis stock investing.

As an entrepreneur, you may seize this opportunity to grow your cash reserves. If you’re also interested, carrying out these steps are vital.

Reassess Your Financial Capacity

Sure, you want to generate more returns and raise your capital. It may help you expand your operating capacity, Yet, you must sustain your operations and cover payables.

Answer these questions. Will there be enough cash left after reinvesting a portion of it? Do I have to borrow to ensure adequate capacity? If the answer is a yes and a no, think twice before proceeding with your plan. Investing in a risky business, means you will need to be okay with losing it all.

Market volatility stays overwhelming even after the recent inflation lull. Interest rates continue to skyrocket, making borrowing costs burdensome. While investing can be promising, liquidity should always be your top priority.

Identify the Types of Cannabis Products

CBD is a natural medicine that can have a profound affect on mediating pain and anxiety.

Due to different views among the states, the reason for the legalization of cannabis varies with its uses. Cannabis is processed either as a medical or recreational product. You will hear words like CBD and THC.

Medical cannabis is legal in 36 US States, three territories, and the District of Columbia. Additionally, over forty countries authorize its medicinal uses. It’s often used to relieve anxiety, depression, stress, and even epilepsy. Even so, one must secure a prescription from a qualified healthcare provider before obtaining it.

Meanwhile, recreational cannabis for adults is legal in 18 US states. It’s also legal in other countries, such as Canada, Mexico, and South Africa.

Identify Cannabis Sources

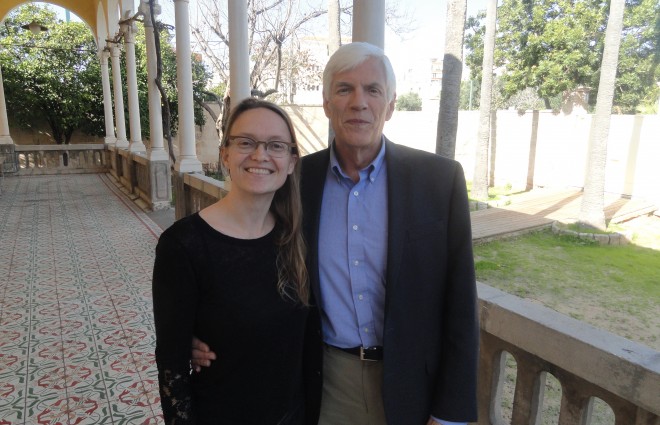

Karin Kloosterman and Alan Shackelford as cannabis entrepreneurs in biotech and agriculture.

There are three primary sources of cannabis.

- Cannabis Growers and Distributors

They cultivate and propagate cannabis in their facilities, harvest the crops, process them, and distribute them to the market. You might also see this industry as agriculture.

- Cannabis Biotech Companies

These companies may join the cannabis industry to extract cannabinoids and develop prescription drugs. They are often headed by a medical doctor and people with PhDs.

- Ancillary Providers

They neither distribute nor develop new products from cannabis. But, they support the cannabis industry with their products and services. These may include lighting systems, hydroponics, and packaging materials.

Determine Different Cannabis Perceptions

Before investing in cannabis stocks, remember that the industry faces various risks and above those special risks, investing in startups and new companies is always risky. Legal and political threats are evident, limiting the capacity to produce, distribute, and expand.

Supply and demand inequality may also be challenging since cannabis can’t be cultivated in other states due to soil quality. Also, some areas have excessive demand, outpacing supply, and vice versa. Other risks include over-the-counter and financial constraints.

Despite this, the cannabis industry has more enticing growth prospects today. The increased awareness of its medicinal uses backs its appeal to the public. Amid legal and political restrictions, many states have decriminalized it.

Its market size is expanding in states where medical and recreational products derived from cannabis are legal. It draws more demand as cigarette, e-cigarette, and vape businesses become open to exploring cannabis for their market, particularly cannabidiol (CBD).

Meet With Business Experts

Before you venture into cannabis investing or mergers, you must consider many factors. You must understand that cannabis skepticism remains prevalent across many regions.

Will it derive more insightful business strategies? Will it affect the legality of your business? How will the market perceive your business? Think about these things a hundred times to avoid potential business problems.

If you and your team are still confused, it may be time to seek assistance from business experts. They are willing to devote their time and share helpful business ideas. From business filings and maintenance to expansion, they will always back you up. They will extend all the help you need for your business plans.

Assess Cannabis Companies

A cannabis greenhouse can control the environment to optimise cannabis strains for medical marijuana

After weighing the risks and opportunities in the industry, look for outstanding cannabis companies. Check their financial statements to determine their performance. In the income statement, you can assess the efficiency of the company. For cannabis growers, you must find the cost-per-gram of cannabis production, excluding depreciation, amortization, inventory adjustments, and the like.

It’s also important to check the cash level relative to its borrowings to know if it can cover repayments. The percentage of cash to current assets will tell you about its liquidity. Other key financial indicators include the Net Debt/EBITDA Ratio, Quick Ratio, Asset Turnover Ratio, Return on Equity, and Debt/Equity Ratio.

Aside from the financial statements, you must observe growth strategies and market positioning. These include mergers, pricing comparisons, and market share. Dividend payments are a plus, especially for publicly-traded businesses.

Once you find the optimal choice, evaluate the stock. Is it reasonable relative to its financial health and dividends? You can use the Price-to-Earnings (PE) Ratio, Price-to-Book Value (PB) Ratio, Discounted Cash Flow Model, Enterprise Value/EBITDA Ratio, and Dividend Discount Model. You can use these ratios even for companies not open to stock trading. After all, it’s your investment you want to assess.

But for public companies, watch the price trend closely. Market perceptions and changes may influence the stock price. Technical traders are particular about stock price patterns. These can be helpful when the stock price moves sideways without a clear indication of reversals. You may also use moving averages to determine the stock price direction. Doing so can help you find an excellent entry point to make a position. A practice called pump and dump is notorious in cannabis stocks. Ask around and make sure the company really does have technology, clients, a business.

Lastly, check if the company complies with the ESG reporting. It is difficult to match cannabis with ESG compliance. But businesses are expected to be more responsible with their production.

Invest in Cannabis Stocks and Observe Market Dynamics

If the company satisfies the conditions, it’s time to invest. But that is just the beginning of your trading journey. You must update yourself on company press releases, financial results, and market changes. It can help you decide to buy more stocks, hold them for the time being, or sell them. Hence, you can avert stock losses or generate gains.

The cannabis industry is a risky but enticing industry to watch out for. It expands with realistic growth prospects despite the challenges. Stock prices are still down, showing an opportunity for an entry point. Yet, you must be careful as economic uncertainties blow the stock market.