The term inflation often makes people break out into a cold sweat every time it’s mentioned and for good reason. Inflation rates affect the prices of basic goods and services which in turn increase the cost of living. We are seeing this in play right now not only in the USA but across the board. What drives inflation is complex and varies from country to country. The below seven factors are common contributors that we see across the globe:

Increase in demand

One of the biggest drivers of rising inflation rates is an unexpected increase in consumer demand for specific goods and services. Think about what panic buying at the start of the pandemic did to the price of toilet paper, N95 masks and hand sanitizer. Suppliers struggled to meet the demands of consumers and so what little stock they were able to produce could fetch much higher prices.

Increased production costs

When it costs a manufacturer or farmer more to produce their product, naturally the retail price is going to be inflated as a result. So, let’s look at a real-world scenario where the price of electricity, gas and fuel have sharply risen. This makes it more expensive for a factory to run their machinery and transport goods to consumers. Their suppliers will be under similar pressure which pushes the prices of raw materials up too. In order to maintain profit margins, manufacturers are left with no choice but to increase their prices, which filters down to the end-consumer.

Supply chain shortages

World events such as the pandemic and Ukraine-Russia conflict or a natural disaster like a drought can cause supply chain disruptions. This means there will be reduced production capacity for suppliers or they will need to seek out more costly alternatives to meet demand. Either way, the cost of the end-product is going to increase significantly. An example of this was back in 2010, where a heatwave in Russia affected Egypt’s wheat supplies due to a temporary ban on grain exports in Russia.

American homeowners are investing in solar energy to beat back inflation

Increase in money supply

This one may surprise you but when there is more money circulating in the economy, the cost of goods and services will generally rise. That sounds a bit counterintuitive though, right? How can more money lead to higher prices, shouldn’t it drive prices down? Sadly not, especially when economic growth is not in line with the money supply. More money in circulation than domestic output will mean the currency weakens and GDP growth slows, both precursors to rising inflation.

Expectations of inflation

We like to think of this one as similar to the law of attraction… when businesses and banks are expecting to see inflation increase, an actual increase tends to follow not long after. This is because businesses will make decisions such as shutting down a production plant or retrenching staff to brace themselves for any downturn in sales. As a result of reduced supply or less competition, inflation goes up.

Exchange rate fluctuations

The exchange rate of a country also has a direct impact on inflation rates. If a currency weakens, investors tend to pull out or pull back on their investments, which puts financial strain on businesses. As a result, the cost of commodities and production increases, directly driving consumer prices higher.

Monetary policy

The monetary policies of a country, such as government spending, tax rates and interest rates, can drive inflation up or down. When the government spends more on public services and goods, it can stimulate economic growth which will in fact drive inflation rates upwards due to increased demand. For example, the Covid-19 stimulus packages have contributed to the current unusually high inflation rates because they provided households with additional spending money, driving up demand and thus inflation.

When governments increase taxes, the disposable income consumers have for purchases is reduced which tends to lower both demand and supply and thus inflation rates.

If a government is in debt and needs to borrow money to fund its spending, this will increase the money supply and as we covered already, more money in circulation than economic growth leads to higher inflation rates.

Final takeaway

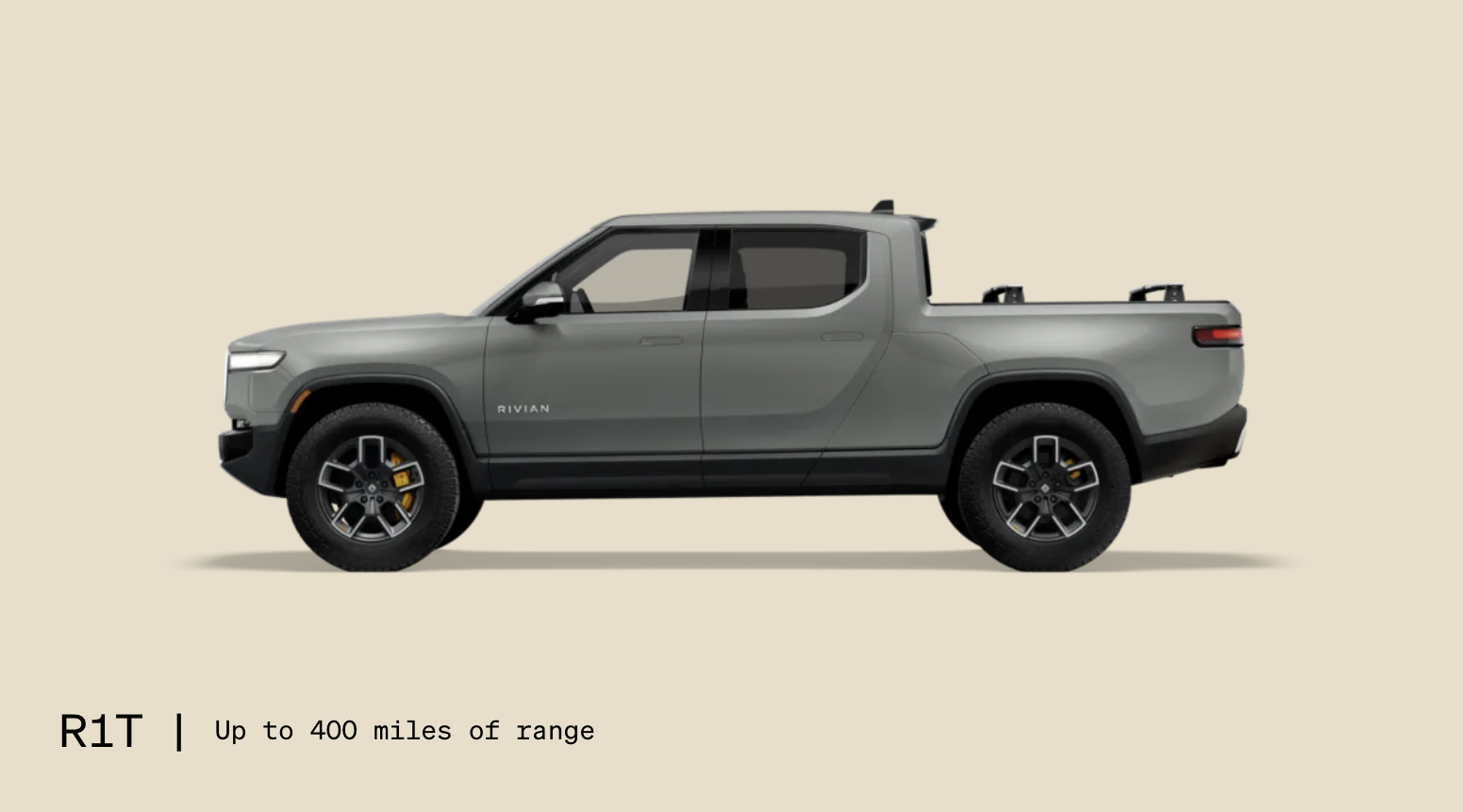

Electric cars will saving thousands on fuel

As we can gather from the above, there are many factors that influence the inflation rates of a country. While some are obvious, others are quite surprising. When examining how these factors interact with each other, it becomes evident they are all closely linked. A change in one could have a resulting effect on another and drive inflation up or down. By understanding exactly what drives inflation, you can be better prepared to deal with the financial consequences on a business or personal level.