The list of banks supporting damaging practices to the Amazon include Banco do Brasil, Rabobank, and JPMorgan Chase.

Amid a tropical forest fire season that is shaping up to be more disastrous than the one from last year, a new database built by environmental activists reveals that global banks, some of which you might belong to, have funnelled 154 billion USD into the production and trade of commodities driving deforestation and land degradation in the three major tropical forest regions –– Southeast Asia, Brazil and Central and West Africa –– since 2015.

Overall, credit to these commodities has increased by 40% since the Paris Agreement was signed in December 2015. As of April 2020, investors also held USD 37 billion in bonds and shares in these companies.

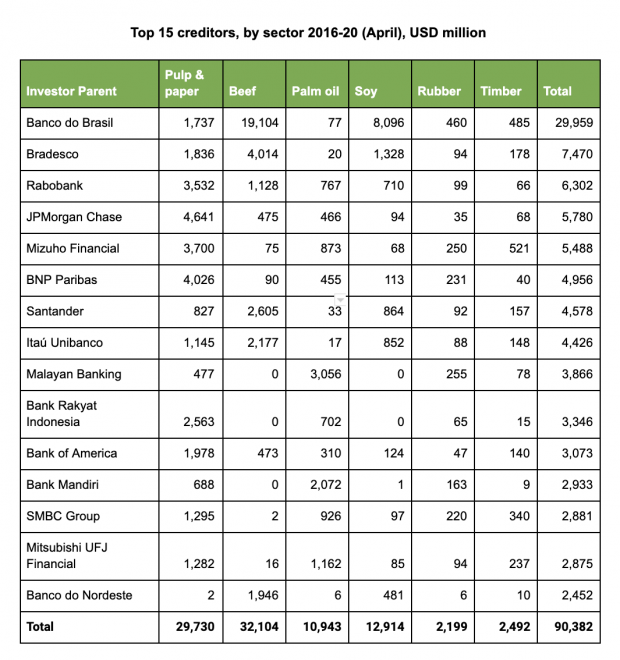

Banco do Brasil was found to be the largest creditor overall, having provided 30 billion USD to forest-risk commodity operations, since 2016. This was almost exclusively for companies operating in Brazil, going into beef, soy and pulp and paper operations.

Also in the top five of largest creditors are the Brazilian bank Bradesco, with USD 7.5 billion, the Dutch bank Rabobank (which lauds its developments in agriculture), with USD 6.3 billion, US-based JPMorgan Chase, with USD 5.8 billion, and Japanese bank Mizuho Financial, with USD 5.5 billion.

I reached out to a contact I have at Rabobank before this research was released and there was no comment.

“Right now, intentionally lit fires are burning through the world’s last remaining rainforests as fire is used as a ‘cheap’ way to clear land for commodity production. Global banks and investors are knowingly financing agribusiness giants that are fueling the fires,” said Merel van der Mark, Coordinator of the Forests and Finance Coalition, one of the groups who created the report.

“Despite the financial sector’s commitments to the Sustainable Development Goals and the Paris Agreement, their pursuit of profits are driving us toward a climate and public health disaster at full speed.”

Launched by Forests & Finance — an initiative by the Forests & Finance Coalition including Rainforest Action Network, TuK INDONESIA, Profundo, Reporter Brasil, Amazon Watch and BankTrack — the database reveals the financial flows between January 2013 and April 2020 to more than 300 of the biggest forest-risk commodity companies whose operations impact forests in Southeast Asia, Central and West Africa, and Brazil.

Banking, lending, and these risks are complicated business. In a way we are all part of it when we buy a non eco product or drive our cars. While we aren’t suggesting to boycott anyone right now, these are definitely questions boardrooms and executives should be asking each other. How can we do this better?

According to the press release sent out by the above groups, they say that “despite various multilateral and industry commitments to zero deforestation, tropical deforestation has nearly doubled over the past 10 years.”

They explain that forests are being primarily cleared for agribusiness commodities, often illegally and with strong ties to corruption, tax evasion and organized crime.

Collectively known as forest-risk, the commodities are beef, palm oil, pulp & paper, rubber, soy and timber. In 2019 alone, tropical deforestation reached 11.9 million hectares. Deforestation and the associated loss of wildlife habitat is also a critical factor in the emergence of zoonotic diseases such as COVID-19, according to the UN Environment Programme.

Credit and investment is critical to the expansion and day-to-day operations of companies responsible for deforestation.

Just 15 banks in the list below accounted for approximately 60% of the USD 154 billion in credit extended to forest-risk companies since the signing of the Paris Climate Agreement, the alliance who funded the research contest.

Eight of these banks are signatories to the UN’s Principles for Responsible Banking, which includes a commitment to align bank operations with the Paris Agreement and Sustainable Development Goals (SDG), including SDG 15 to “halt deforestation [and] restore degraded forests” by 2020. In terms of source finance, banks from Brazil, China, Indonesia, Malaysia, United States and Japan represented the largest flows of finance. These findings illustrate the lack of regulations and company policies necessary to bring the financial sector into line with global environmental and social priorities.

“The Amazon’s indigenous peoples are facing a catastrophic burning season heaping tragedy on the toll of the COVID-19 pandemic,” said Christian Poirier of Amazon Watch. “Fires across the Brazilian Amazon are at a 10-year high, with a 77 percent increase on indigenous territories since last year. These spikes are the product of criminal deforestation and arson fueled by forest-risk commodities and bankrolled by global financial giants. To global banks and investors: this database unequivocally exposes your complicity in this disaster.”

The research methodology segregates and calculates credit and investment that can be reasonably attributed to the production, primary processing, trading, and manufacturing divisions of companies with forest-risk operations in each tropical forest basin.

Below is a table with information on loans and underwriting provided by the top 15 creditors to forest-risk commodity companies across the three tropical regions, with a breakdown per sector.

We’d love to hear the banking side of the story. Reach out for a contributing voice [email protected]

Great article that sheds light on a growing problem of money supporting industry that is destroying great resources. Awareness and pressure to force good money into more sustainable industries that support the eco-system should be encouraged and our own purchasing power as consumers needs to start supporting more eco-friendly products forcing manufacturers to offer better products!