Is CEO greed unsustainable for shareholders?

In a sobering turn of events, 23andMe, the once-celebrated pioneer of direct-to-consumer genetic testing, has filed for Chapter 11 bankruptcy. This development has ignited a critical conversation about corporate governance, executive compensation, and the ethical stewardship of sensitive consumer data.

“This unfortunate series of avoidable events reminds me to watch for the blinking red lights and avoid these stocks. When your whole Board of Directors resigns, there might be a problem,” says Michael Cooper of MySayOnPay who has been particularly vocal about CEO overpay in publicly-owned companies, attributing the company’s downfall to “greedy executives” and “incompetent monsters” at the helm, specifically pointing to the substantial compensation packages awarded to executives amidst the company’s financial decline.

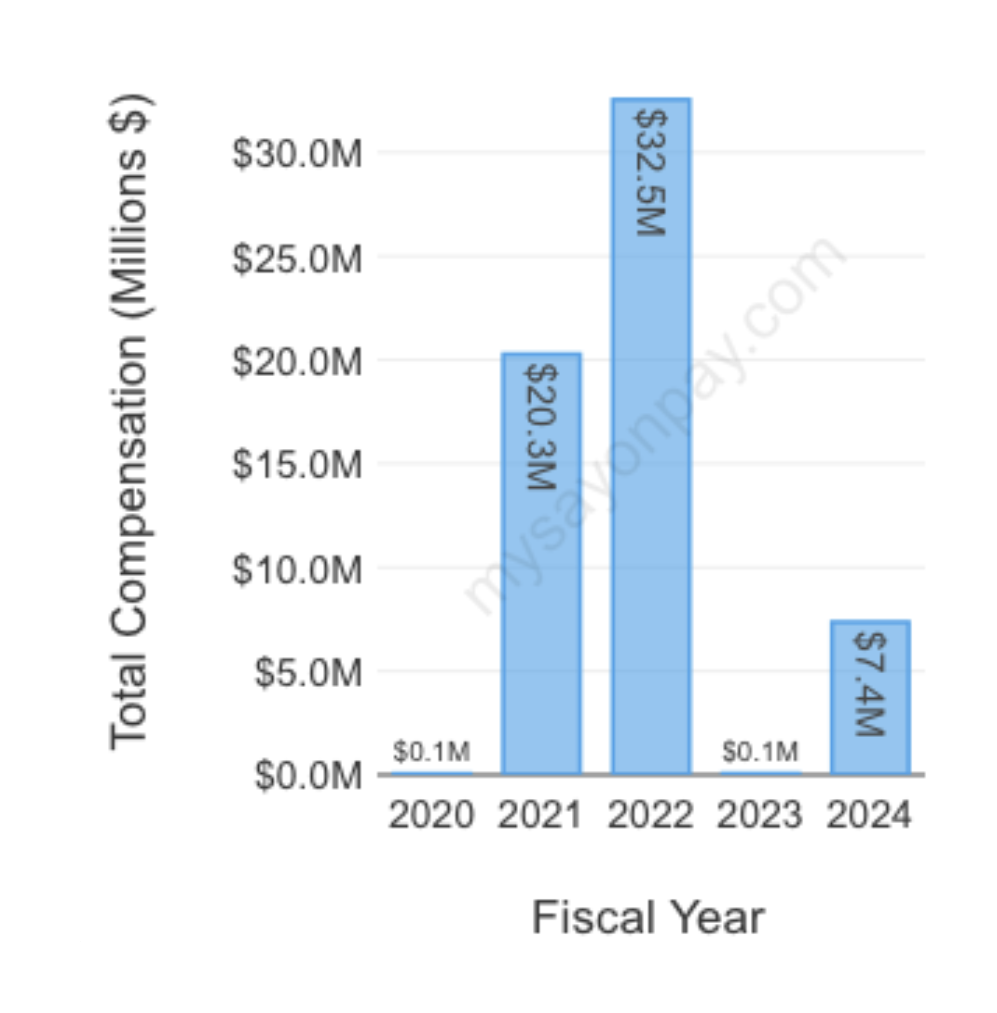

23andMe Board of Directors paid Wojcicki $60 million over 5 years. Compared to her peers, Wojcicki was the rock star earner, says Cooper: “All while burning through billions of shareholder value. Sadly this is not a shocking outlier.”

Founded in 2006 by Anne Wojcicki, Linda Avey, and Paul Cusenza, 23andMe revolutionized the biotech industry by offering affordable at-home DNA testing kits. The company’s mission was to empower individuals with knowledge about their genetic makeup, fostering a proactive approach to health and ancestry exploration. Early success attracted significant investments, including backing from Google co-founder Sergey Brin (Wojcicki’s ex-husband) and propelled the company into the public eye.

Related: How excess CEO pay affects us all

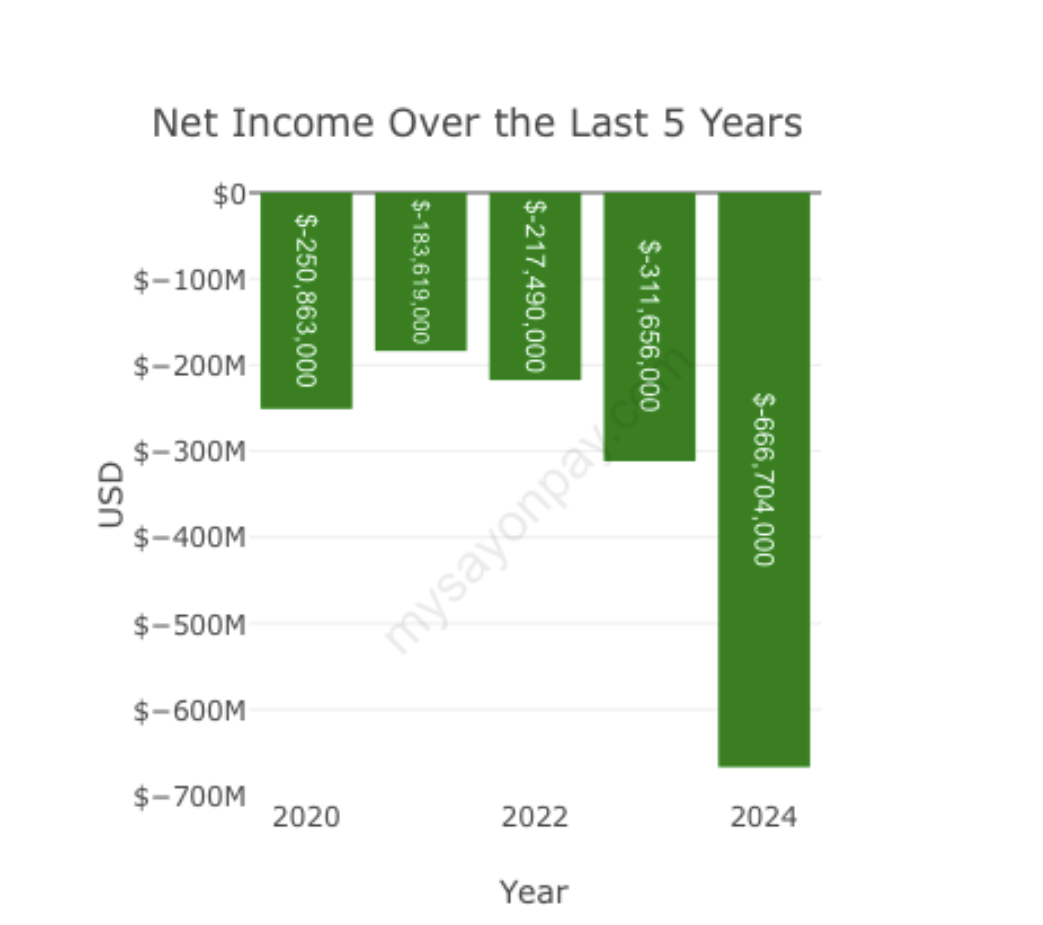

However, the journey was fraught with challenges. Regulatory hurdles with the FDA, concerns over data privacy, and a significant data breach in 2023 that exposed information of nearly 7 million customers eroded consumer trust and tarnished the company’s reputation. Despite efforts to diversify services and secure additional funding, 23andMe struggled to maintain profitability, leading to layoffs and, ultimately, the recent bankruptcy filing. But a point of contention among shareholders should be the CEO’s overall compensation over the last 5 years.

Executive Compensation Amidst Decline

A focal point of criticism has been the compensation of CEO Anne Wojcicki, Cooper points out. He is a shareholder watchdog for publicly traded companies and advises individuals on how to invest sustainably through a hive-mind boutique service called 36 North. In the fiscal year ending March 31, 2024, Wojcicki received a total compensation of $7,363,723, Cooper finds, with a base salary of $65,000 and the remainder in stock options. “This figure is particularly striking given the company’s reported net loss of $667 million for the same period,” he says pointing to a study he created that compares the pay packages of the CEOs at leading American companies.

Cooper has highlighted this disparity: “23andMe: the CEO took out $60 million in compensation over the last five years. To me that number suggests you are an all-star company builder. Not some amateur looking for on the job training – how can these incompetent monsters be permitted to access our data, our DNA data?”

His remarks underscore a broader concern about the misalignment between executive pay and company performance, especially in industries handling sensitive personal information.

The Unsustainable Pursuit of Profit

The situation at 23andMe serves as a cautionary tale about the perils of prioritizing short-term financial gains over long-term sustainability and ethical responsibility. When executives and shareholders focus excessively on immediate profits, they may neglect critical aspects such as data security, customer trust, and environmental stewardship. This approach is not only detrimental to the company’s longevity but also poses risks to consumers and the broader ecosystem.

A Call for Ethical Corporate Governance

The downfall of 23andMe highlights the urgent need for corporate structures that balance profitability with ethical considerations. Companies, particularly those handling personal and sensitive data, must adopt transparent practices, ensure fair compensation aligned with performance, and prioritize the well-being of their customers and the environment.

As we reflect on 23andMe’s trajectory, it becomes evident that sustainable prosperity cannot be achieved through greed and exploitation. Instead, a commitment to ethical ladership, responsible data stewardship, and environmental consciousness must guide corporate strategies to foster trust, resilience, and long-term success.

The story of 23andMe serves as a poignant reminder that the relentless pursuit of profit, devoid of ethical grounding, is a precarious path—one that can lead to the erosion of trust, financial ruin, and the loss of invaluable resources, both human and environmental.

Read More: how to build a 100 year old company