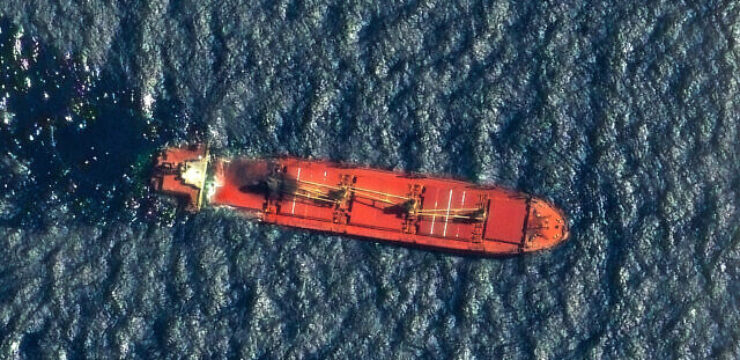

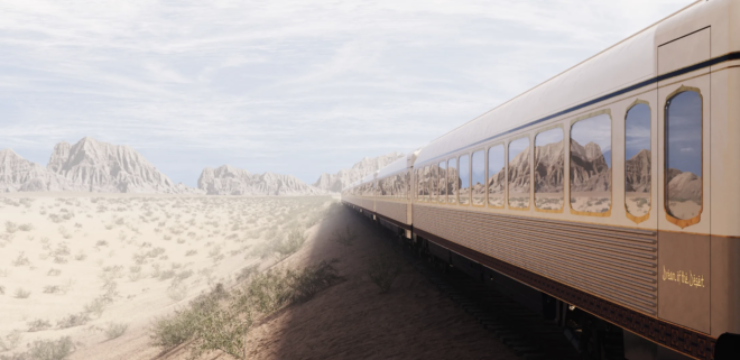

AI finds impact of noisy ships on dolphins

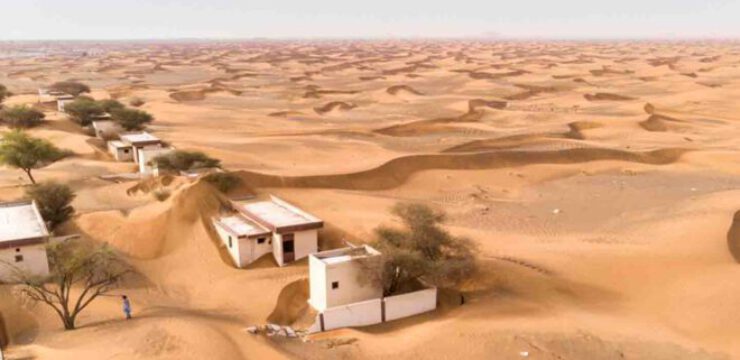

Maritime traffic has a very strong impact on the environment and public health in general and on the marine environment in particular, and is a factor that motivates the migration of species from one marine environment to another.